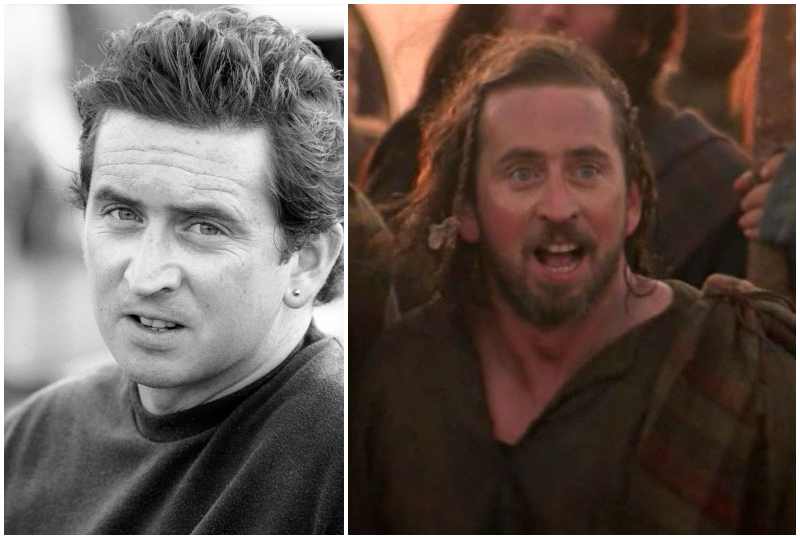

Steve Conley: Adviser otherwise planner? Theres a critical distinction and you may charges will be mirror that

We have learned about latest lingering information costs critiques and later years money suggestions feedback you don’t charge economic thought relationships costs whenever offering strictly transactional monetary guidance features. The brand new difference between the 2 grew to become evident to any or all.

1) New agent rarely requires just what reason for the bucks is. Immediately after a desires investigation, the requirement is viewed as suitable if it possess a related insufficiency that is important you want. As an example, a pension contribution is viewed as compatible when there is a matching retirement earnings gap.

Brand new review is not just a deal out-of a review, its a genuine comment you to definitely inspections advances and you can confirms viability.

Think is far more on the relationship. There’s a great plan regarding A to B. They covers an individual eg just one, far less a secured item.

Just before planning the profit, the fresh coordinator arrangements the consumer. The brand new planner enquires as to what money’s meant play with. Following the consumer’s lifetime and you can heritage requirements, a lifetime cashflow package and you can a legacy plan are created.

The fresh new planner explores the latest adequacy of one’s guidance and the life plan on ratings. It is not just the fresh investable assets which can be removed towards the membership from the planner; most of the assets was.

Finding life requirements considers the brand new liquidity away from other possessions, also assets, company and pension property. Knowing the intended use ekte British kvinner for ekteskap of the finance, the fresh planner takes into account new entry and you can accrual fees together with eventual recipients, time and you may associated decumulation and you will hop out fees.

Such as, the importance of if possessions are to the or away from property to have heredity income tax is recognized as with regards to related funding growth and you may earnings.

The proper advantage allowance try objective-centered. The new plan’s alternative approach takes into account new clients’ wide range and you will wellness inside the all the spheres, including life expectancy and you will fitness. More exactly what if’ choices is considered, given that will be consumer’s financial habits and you may habits.

Habits and you may reasons are included in the new lingering opinion. The fresh new clients’ motives are required to shift regarding the package of conference its inadequacy conditions to pursuing their gains specifications.

A twin-registered monetary coordinator and you may agent will bring considered and you will advising properties, charging sensible and cost-energetic fees. Very, it could sound right an economic planner or adviser that would maybe not render twin qualities perform costs less overall. However, do one occur in routine?

Multiple economic coordinators just have already been bringing monetary guidance characteristics. As we can see in the old-age money analysis, a lifetime economic forecast try an important element of people monetary bundle. Although not, surveys recommend only one in two economic planners has provided one to. More simple means is for firms that specialise inside pointers to refer from what they are doing because the pointers instead of monetary considered.

Younger generation prefers brand new part away from a planner to an enthusiastic agent. A number of our very own Gen Z academy players who enjoy cashflow think have experienced to change organizations as his or her compliance communities forbade the application of income patterns at their earlier boss.

Steve Conley: Adviser otherwise planner? There was a vital change and costs should echo one

This new FCA mentioned organizations would be to clarify the support provided when readers purchase persisted guidance. We hope, this can end in so much more understanding towards if think or advisory features arrive. Would firms that merely offered pointers be likely to help you costs faster as opposed to those one offered financial thought and suggestions? Possibly.

In that case, commerciality will discover direct consultative qualities making use of their vehicles-rebalancing qualities more and robo-consultative otherwise limited consultative habits because they getting obtainable, where there’s stress in order to costs below men and women bringing suggestions and you will believed.

Because the technical takes on an even more high role from inside the consultative functions, advisers need to adopt the fresh new experience kits while they change from transactional to dating patterns, which enhances the demand for earnings model, financial instruction, lifestyle believed and you can behavioural fund studies.

Comments

So many presumptions have been made to help with foolish significance. Coordinators, riches professionals each of them suggest. Do you genuinely believe that the majority of decent advisers never plan? Yes you will find terrible advisers and you may I know discover bad coordinators who like to full cover up behind what they perceive while the an effective more prestigious identity. The only real differences well worth making was between it’s separate practitioners and the rest.

Deja una respuesta